We Help People Retire With Confidence

Retire With Confidence

There are many financial advisors and financial planners you can choose, but fewer who choose to put their clients' priorities before their own profits. We uphold Fiduciary principles to always put your interests first - ahead of our own and that of our firm and our employees. We believe that the best way to take care of us is to take the best care of you and your family.

To learn more about how we can help you retire with confidence, best protect your family's wealth from marketplace fluctuations, and always move forward in a way which aligns with your values, contact us today.

Free eBook

Enter your email below and we'll send you your own copy of 3 Steps to a Tax-Efficient Retirement Income.

We won't send spam. Unsubscribe at any time.

Meet the Team

Better yet, let your financial advisors get to know you. When we learn about your goals, lifestyle, and priorities, we can help you best financially plan to land where you want to be and take flight to where you want to go.

Joe Elsasser

CFP®, FINANCIAL PLANNER

As both a practicing financial advisor and the founder of a financial software company, Joe has been featured or quoted in several local and national publications including the Wall Street Journal, the Journal of Financial Planning, USA Today, MarketWatch, CBS MoneyWatch, Kiplingers, Money Magazine, and Accounting Today.

He has testified as an expert witness in court proceedings on Social Security and pension valuations, and delivered continuing professional education for other financial advisors, CPAs and attorneys.

Joe is a Certified Financial Planner™, licensed Investment Advisor Representative of Adaptive Advice, LLC and licensed insurance agent. He holds a Bachelor’s degree with honors from the University of Nebraska Omaha.

In his spare time, Joe enjoys watching a ridiculous number of kids’ sports and school events with his wife and two children.

Schedule a MeetingMike Chochon

FINANCIAL PLANNER

With over 30 years of experience working with both large and small companies, Mike Chochon brings his financial expertise directly to individual clients.

Just as companies strategically manage their financial resources to achieve growth and profitability, individuals can apply similar principles to their personal finances. By starting with your personal balance sheet, much like a company evaluates its financial statements, we can develop a plan that maximizes tax efficiency and ensures a secure retirement. Understanding and managing your finances with the same discipline and foresight that businesses use can empower you to achieve your financial goals.

Mike's career started at Ernst & Young (EY), where he focused on tax situations as a CPA. He progressed into finance and treasury roles before entering the financial services industry in the late 1990s. In financial services Mike notably directed a capital raise of over $2 billion for TD Ameritrade. More recently, Mike successfully expanded into a Registered Investment Adviser (RIA) from 2 financial advisors to over 65 advisors nationwide.

Mike and his wife, Genice, just celebrated their 30th anniversary. They have lived in all four U.S. time zones and are parents to three grown children: Chris, Morgan, and Carson. In his downtime, Mike enjoys spending time in his yard, which recently served as the venue for his oldest son's wedding, traveling with family, and watching sporting events.

Schedule a MeetingMatt Sargent

PROCESS SPECIALIST

With over 15 years’ experience in project management, Matt Sargent plays a key role at Adaptive Advice, monitoring and developing processes that allow us to better support our clients through every stage of their financial journey. He is involved in document preparation, workflow preparation, and monitoring, while also coordinating services and insurance solutions. His focus is on helping Adaptive Advice deliver organized, thoughtful support that helps clients move forward with clarity and confidence.

Jaime Elsasser

OFFICE MANAGER

Jaime Elsasser is the Office and Administrative Assistant at Adaptive Advice and helps keep day-to-day operations running smoothly. She schedules and confirms client meetings, coordinates in-office appointments, and ensures annual client reviews are properly tracked and audited. Jaime also manages office operations and bookkeeping, including check processing, reconciliations, receipts, and payroll. Her attention to detail and organization help support both the advisory team and the clients they serve.

Matt Sorum

MARKETING SPECIALIST

Matt Sorum is the Marketing Strategist at Adaptive Advice, responsible for growing awareness and strengthening relationships with prospective and current clients. He leads content creation for advertising and the website resource library, ensuring messaging is clear, compliant, and client focused. Matt also manages campaign deployment, tracking performance, and refining strategies to continually improve engagement and reach. His work helps connect the firm’s planning philosophy with the people it’s designed to serve.

Kurt Jacobson

INDEPENDENT INSURANCE AGENT

As an independent insurance agent and trusted partner with more than 10 years’ experience, Kurt Jacobson, who offices out of Adaptive Advice, helps clients navigate insurance decisions with clarity and confidence. He specializes in Medicare education, guiding individuals who are new to Medicare—whether they are turning 65 or transitioning into retirement—so they can make informed decisions that truly fit their needs. Kurt is committed not only to helping clients choose the right coverage, but also to providing ongoing support and guidance well after those decisions are made.

Customer Experience

Selecting the right financial advisor is no small feat. Crucial factors such as experience, competency, trustworthiness, and transparent fees demand careful consideration. So, how can you ensure you're making the best choice?

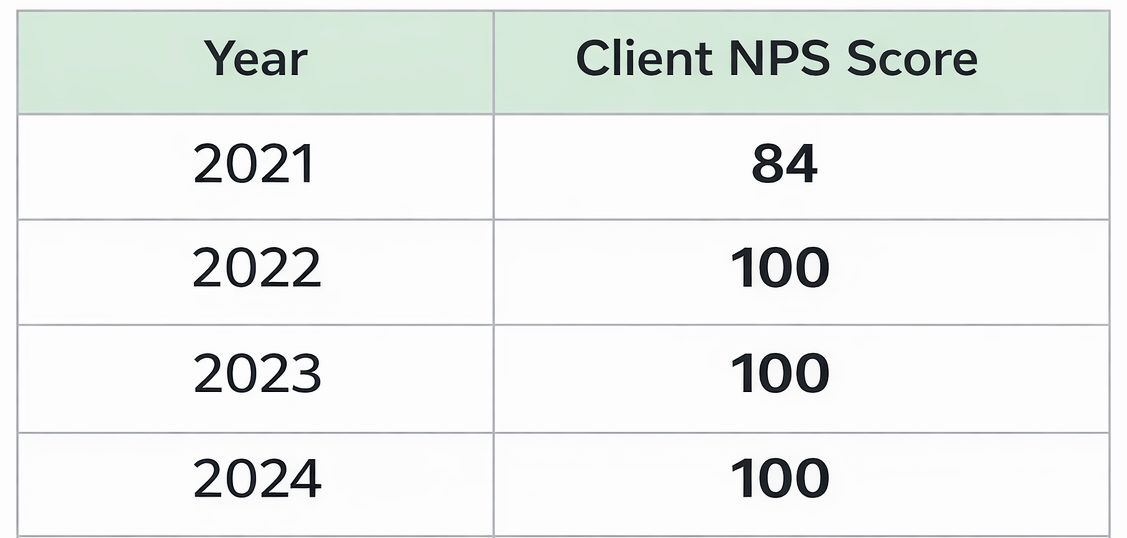

We believe client surveys as the most reliable method to gather honest and valuable feedback. Each year, we email all of our ongoing investment management clients a survey through a third party, aiming for continual improvement. We do not compensate clients or incentivize responses in any way.

The Net Promoter Score (NPS), devised by Bain & Company and spotlighted in the Harvard Business Review in 2003, has become widely adopted, with two-thirds of the Fortune 1000 using it to assess client satisfaction.

Central to the NPS is a single question: "On a scale from zero to 10, how likely would you be to recommend our company to a friend?"

This question captures the essence of client satisfaction. Everything we do, from the advice provided to the service experienced and the outcomes clients achieve, all in relation to the advisory fees paid, contributes to overall client satisfaction.

NPS scores range from -100 to +100, providing valuable insights when benchmarked against industry standards.

Adaptive Advice is proud to share our historical NPS scores, ranging from 84 - 100 over the last 5 years - well above the Financial Services industry average of 44*.

Welcome to our growing library of video training and resources to help you feel more confident about retirement and investments.

We encourage you to register for a free account to unlock our complete content library.

Services and Fees

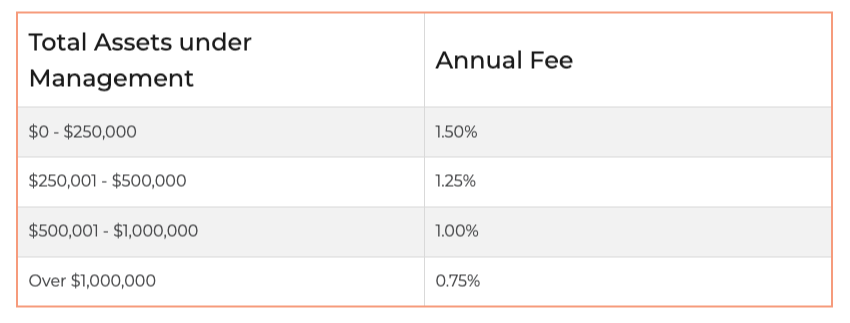

Financial Planning fees start as low as $500 based on the complexity of a client's situation.

If you work with us to manage assets on your behalf, Financial Planning is included with no separate fee and the ongoing fee is billed based on the assets we manage for you:

For example, the total fee for ongoing financial planning and management of a household with total invested assets of $1,500,000 would be as follows:

Five Pillars of Client Care

Adaptive Advice, LLC is a Registered Investment Advisor committed to upholding a fiduciary standard of care.

Our Investment Advisor Representatives agree to the following:

Clients First

We will always put our clients’ best interests first — ahead of our own and that of our firm and its employees. As defined by federal law, we will act as a fiduciary.

Fair Pricing

When selecting investments and/or investment strategies, we will act as the client's agent, seeking the best investments at the best prices at all times.

Sound Judgment

While neither we nor anyone can promise superior investment returns, we will provide impartial advice and act with skill, care, diligence and good judgment.

Full Disclosure

We will provide full and fair disclosure of all important facts, including our compensation from the providers of the products and services we offer, as well as all fees we pay to others on your behalf.

Fair Management

We will fully disclose and fairly manage any unavoidable conflicts in our clients’ favor.

Client Center

Getting Started Is Easy

Contact Us

Submit the form below and we'll be in touch shortly.

Adaptive Advice, LLC

444 Regency Parkway Dr.

Suite 201

Omaha, NE 68114

Phone: 402-281-2486

ADAPTIVE ADVICE LLC IS A REGISTERED INVESTMENT ADVISER. INFORMATION PRESENTED IS FOR EDUCATONAL PURPOSES ONLY AND DOES NOT INTEND TO MAKE AN OFFER OR SOLICITATION FOR THE SALE OR PURCHASE OF ANY SPECIFIC SECURITIES, INVESTMENTS, OR INVESTMENT STRATEGIES. INVESTMENTS INVOLVE RISK AND UNLESS OTHERWISE STATED, ARE NOT GUARANTEED. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER AND/OR TAX PROFESSIONAL BEFORE IMPLEMENTING ANY STRATEGY DISCUSSED HEREIN.

This communication is strictly intended for individuals residing in states where Adaptive Advice LLC is either registered or exempt from registration.